Rob Go

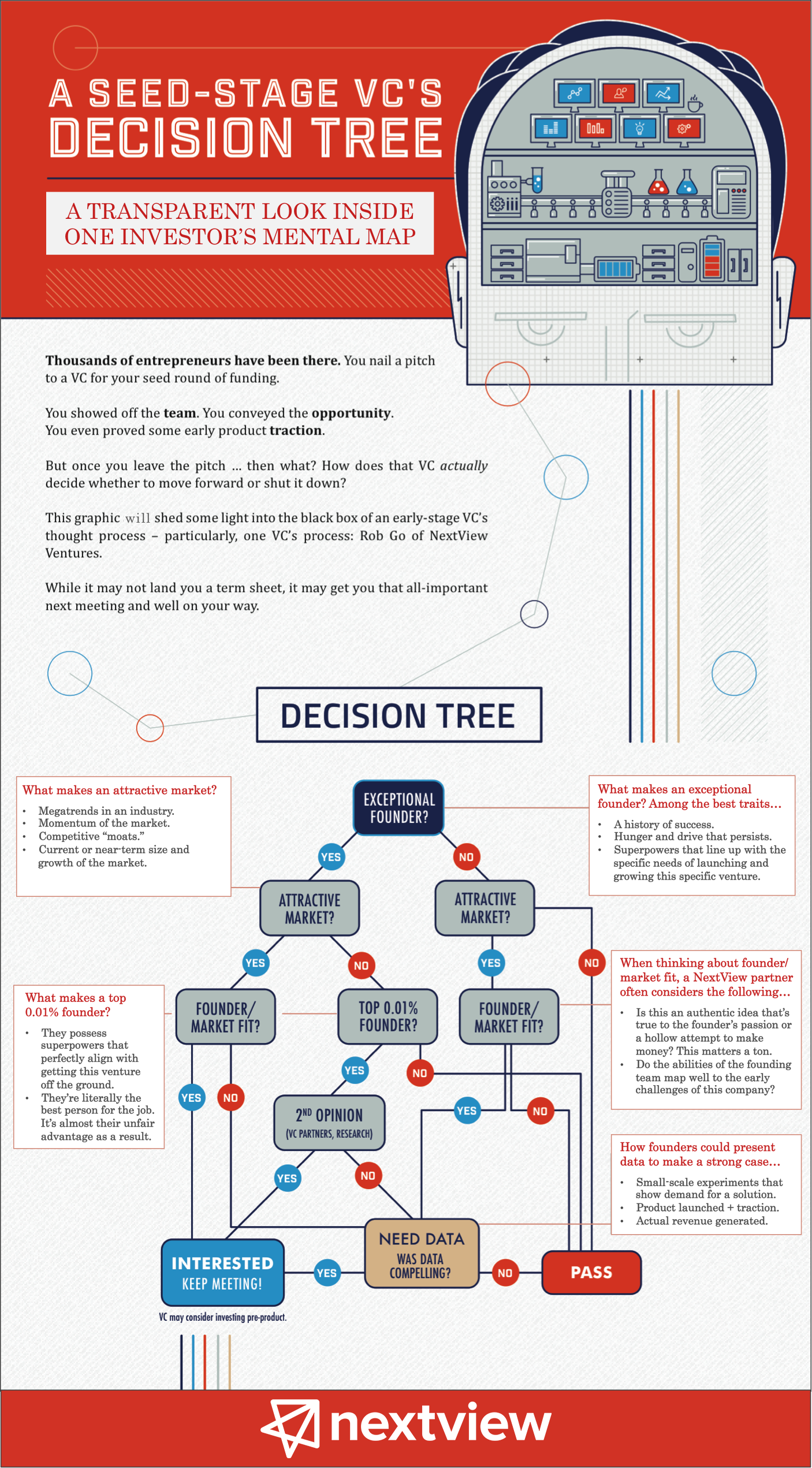

Ed. note: In 2013, Rob Go published a flowchart articulating his VC decision making process. Below, we’ve updated that graphic with new information in order to stay current and provide more context and transparency around each node.

At NextView, we hold regular team offsites to step back and think about how we do everything from invest in seed-stage companies to create better platform initiatives in support of the Boston and New York startup ecosystems. Along those lines, we’ve created the below flowchart as an update of my original. As with that version, this is the internal dialog I tend to have with myself when evaluating companies. And just like our offsite helps us articulate how we make investment decisions as a firm to each other, this flowchart helps me remember the attributes I’m looking for and how my opinion about different attributes feeds into an ultimate decision.

While some of this process remains internal to my/our process, I’m again sharing a high-level idea of how I make decisions, particularly around whether or not to invest more time in meeting with a founder again.

Five of the first questions I ask are:

- Is this an awesome founder?

- Is this a market I want to have an investment in? This incorporates both the total size potential of the opportunity and the attractiveness of the market itself.

- Is there strong founder-market fit?

- Is this an authentic idea to the founding team? Did they have some experience that led them to want to solve this problem? This can mean all the difference between actually running through walls to succeed or just trying to make a quick, easy buck but without the conviction needed to fight towards traction and growth.

- Does the capability of the founding team map well to what’s needed to succeed in the early stages of the business?

Here is the decision tree with some commentary on the different processes and nodes. (Click to view the larger version.)