Dimitri Dadiomov

Going to business school and becoming a startup founder are often positioned as conflicting choices by the media and startup bloggers. Some go as far as stating, flat out, that MBAs don’t make for good founders. Others are more practical: If you want to start a company, they ask, does it make sense to go to business school and pay $120K in tuition, or should you save up and put that money directly into your company?

There is no single right answer. So we decided to study one program in particular: Harvard Business School. (Disclosure: I’m a second year MBA candidate at HBS.) After constructing an exhaustive data set of recent Harvard Business School alums who are also startup founders, the answer became much clearer: There is no conflict between attending business school and founding companies.

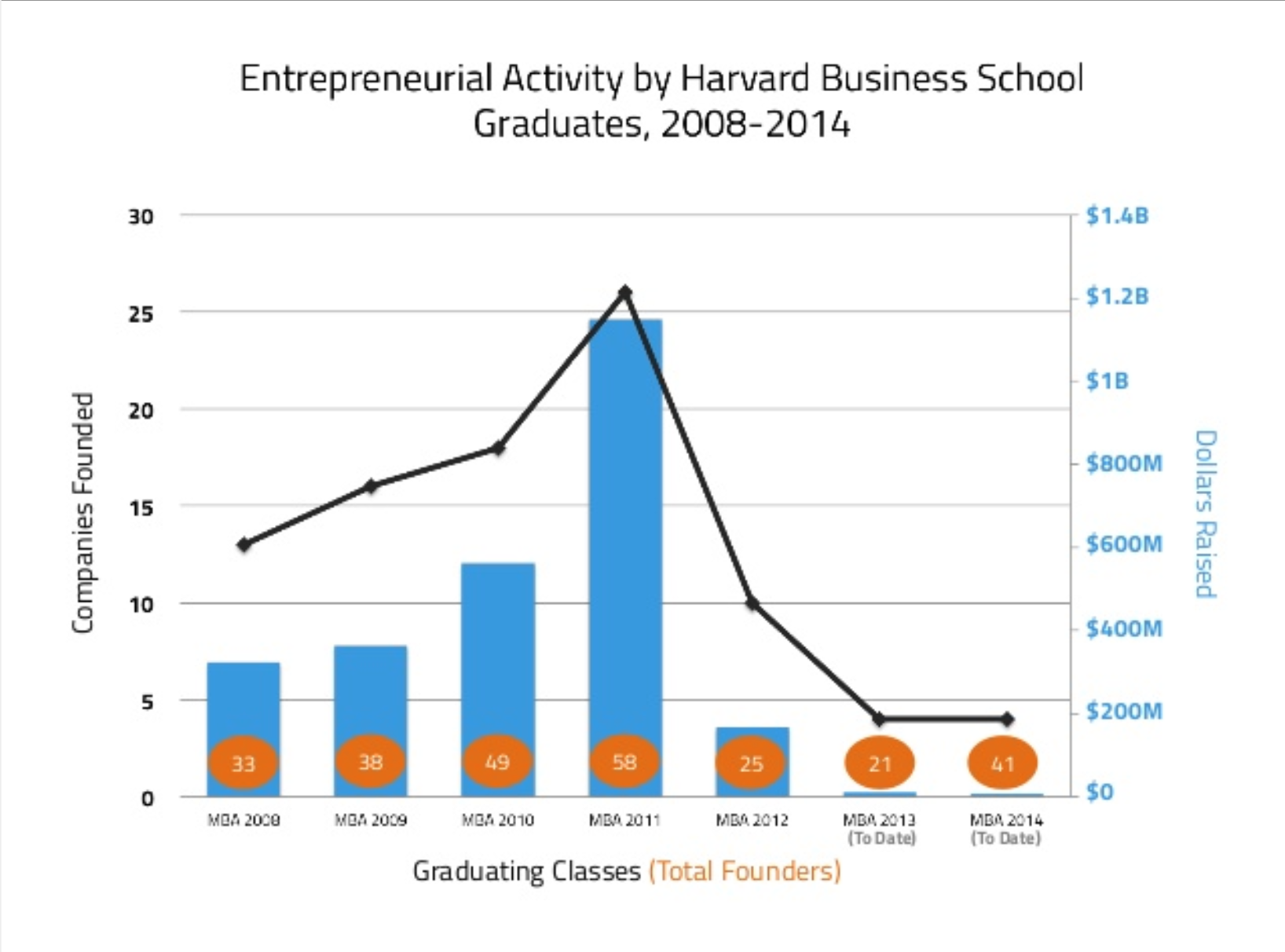

In fact, there are over 250 founders from the HBS classes between 2008 and 2014. Combined, they’ve raised over $2.5 billion in capital to date for the 90+ companies they launched. That’s a pretty astounding figure, especially when you consider that many students in the latter years of that cohort have yet to raise or have yet to raise later-stage, larger rounds.

Let me be the first one to state that fundraising does not equal success – some of the best companies are bootstrapped for a long time and raise money only sparingly, if at all. I’ve also seen firsthand how capital doesn’t automatically equate to success. After Stanford undergrad, I helped start and build Better Place – at one time famous for raising a $350 million Series B in what the Economist called the “Netscape moment for Cleantech,” only to end up infamous and in bankruptcy almost a billion dollars of funding and five years later. So I have personal scars from what it means to over-index success using fundraising as the key metric. Success and fundraising are not one and the same.

However, fundraising can be used as a helpful proxy for entrepreneurial activity, and so inspired by Brent Grinna, who first quantified the disproportional presence of business school founders and executives amongst the so-called Unicorn startups, I went through and looked up the last seven years of HBS alums and looked for people who self-described themselves as co-founders.

Harvard MBA Startup Founders: 2008-2014

Incredibly, the 266 HBS alumni I identified have collectively raised over $2.5 billion in venture funding. You can see the summary data below:

A few of these have become known tech names, such as Wildfire Interactive (acquired by Google), Behance (acquired by Adobe), Rent the Runway, Cloudflare, Blue Apron, and more.

Others are dominating categories in foreign markets, such as Dafiti, Linio, Coupang, and Grabtaxi. Also among these companies are a few startups backed by NextView Ventures, which I mention here to be transparent about the reason we conducted this study. These startups include Boston-based InsightSquared (raised $27M to date), San Francisco-based ThredUp ($50M to date), and RentJuice (acquired by Zillow).

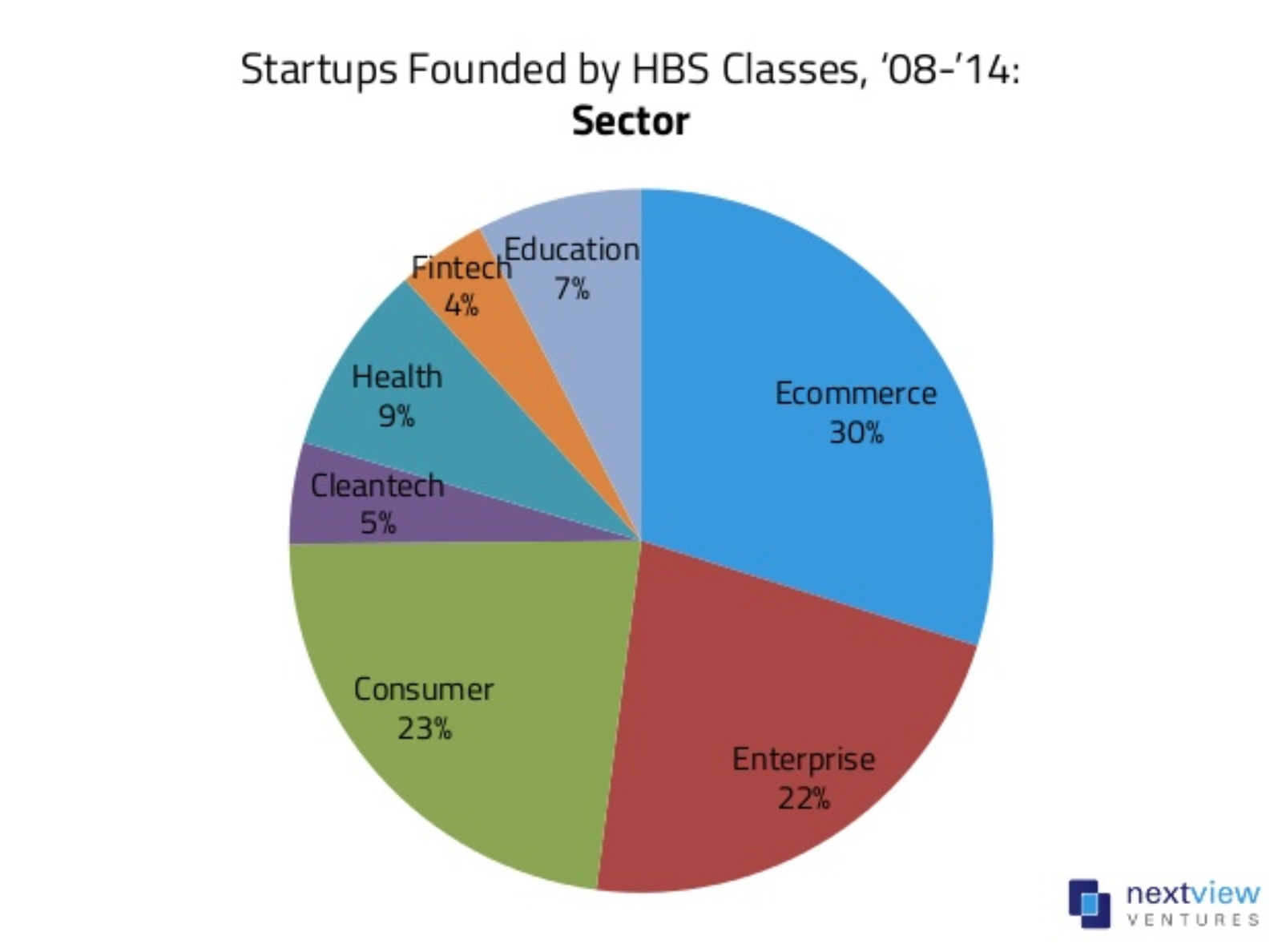

So what are all these HBS-spawned companies doing? In short, a lot of very different things – there was no single sector that defined the group. The chart below shows a sector breakdown. As you can see, it’s relatively broad, with a notable 30% specializing in ecommerce.

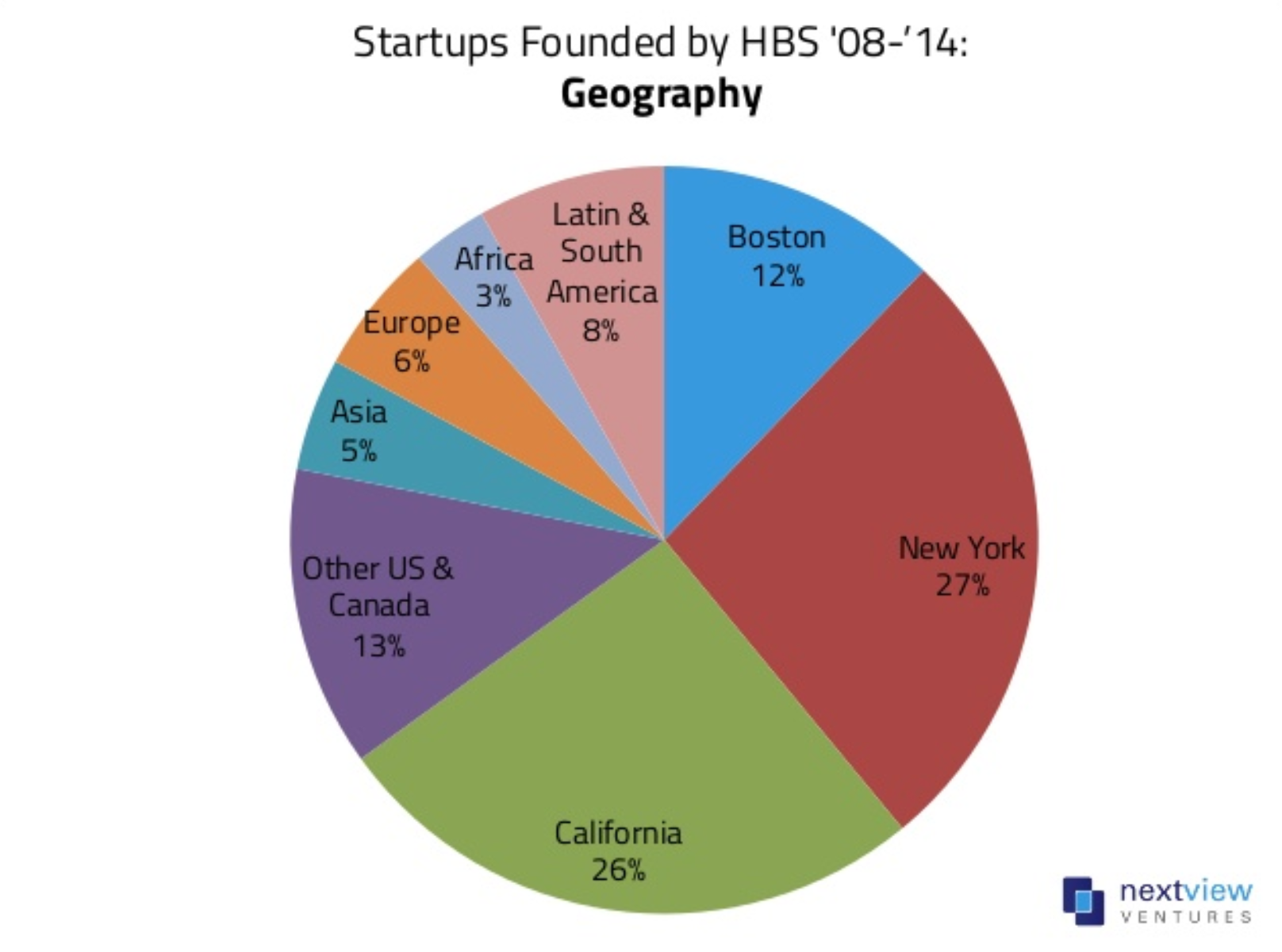

As for location, most are in North America, and not surprisingly, they are disproportionately located in Boston and New York (39%). Also not surprisingly, many are in California (26%). But 22% of the startups founded by HBS alums are outside North America, with some ending up very dominant in their home markets.

As in all things startup-related, the distributions are not even. The companies most successful at fundraising have raised orders of magnitude more than the rest. Some of the biggest fundraisers to come out of HBS in the past few years include regional ecommerce leaders Coupang (Korea, with $400M raised), Linio (Mexico; $175.5M), and Dafiti (Brazil; $249.3M), US-based ecommerce innovators Birchbox ($71.9M), Rent the Runway ($114.4M), and Blue Apron ($58M), health insurance disruptor Oscar ($150M), Uber’s competitor in Southeast Asia, GrabTaxi ($330M), and security technology leader CloudFlare ($72.1M).

The Verdict: Business School or Launch a Startup?

The goal of this study is not to suggest that a founder delay the pursuit of an idea he or she is passionate about today in order to spend two years at business school. Neither do I believe that attending business school automatically it is all that much easier to raise funding or start a successful company.

But the notion that attending business school is somehow a nail in your entrepreneurial coffin is simply untrue, at least when it comes to HBS. In the Boston ecosystem, Harvard Business School has long been a target of local tech press and even national dialogue, mainly describing the school’s apparent lack of widespread entrepreneurial success.

We’re still in the early years of watching these particular Harvard alumni launch and build their businesses, but if there’s one thing to which MBAs and startup founders can both relate, it’s data. And the data suggests we ought to look harder at HBS as a key player in the startup world.

A word about methodology and the underlying biases of this study:

The database of startups and founders was constructed by looking for alums who self-described themselves as founders, co-founders, CEOs, and other such telling job titles. Not too surprisingly, the classes of 2013 and 2014 had a notable lack of alums describing themselves as such—partly because many grads work for a year or two after getting their MBAs before founding their companies, and partly because many grads who launch something immediately after school remain in stealth mode for some period of time.

In terms of outlier success, the Class of 2011 was by far the standout entrepreneurial class, with 58 founders cumulatively raising $1.15 billion to date. But even ignoring that year and looking only at the classes of 2008-2010, HBS classes gave birth to startups that raised a bit over $400 million on average within five years of graduation. That means that the classes of 2012-2014, which so far have raised a bit under $200 million among all companies, could represent $1 billion of further investments likely to occur over the next couple of years. All eyes on you, classes of 2012, 2013, 2014!

[Editor’s Note: We’ve embedded this study and commentary in SlideShare format below. SlideShare was experiencing an error displaying certain cover slides at the time we published this, so please click through to view the full version.]