David Beisel

The bulk of written guidance for VC fundraising meetings is centered on the very first meeting: how to get it, how to prepare a pitch deck, how to run the meeting, etc. But then the tactical advice stops. What about the rest of the VC fundraising process? How should an entrepreneur approach the full set of meetings during a fundraise?

The first rule of venture fundraising is: the purpose of all VC meetings is to get another meeting. It’s not to push a decision immediately.

VCs don’t like wasting their or their partners’ time. So they’re not going to be conducting multiple meetings if there isn’t a serious prospect of a startup becoming an investment. Unlike “traditional sales” where there’s an eye towards closing sooner rather than later because a large part of the process is convincing the other party now is the time to buy, VCs (if they have capital to invest) are always ready to buy. They just have a set procedure for doing so which doesn’t really deviate that much.

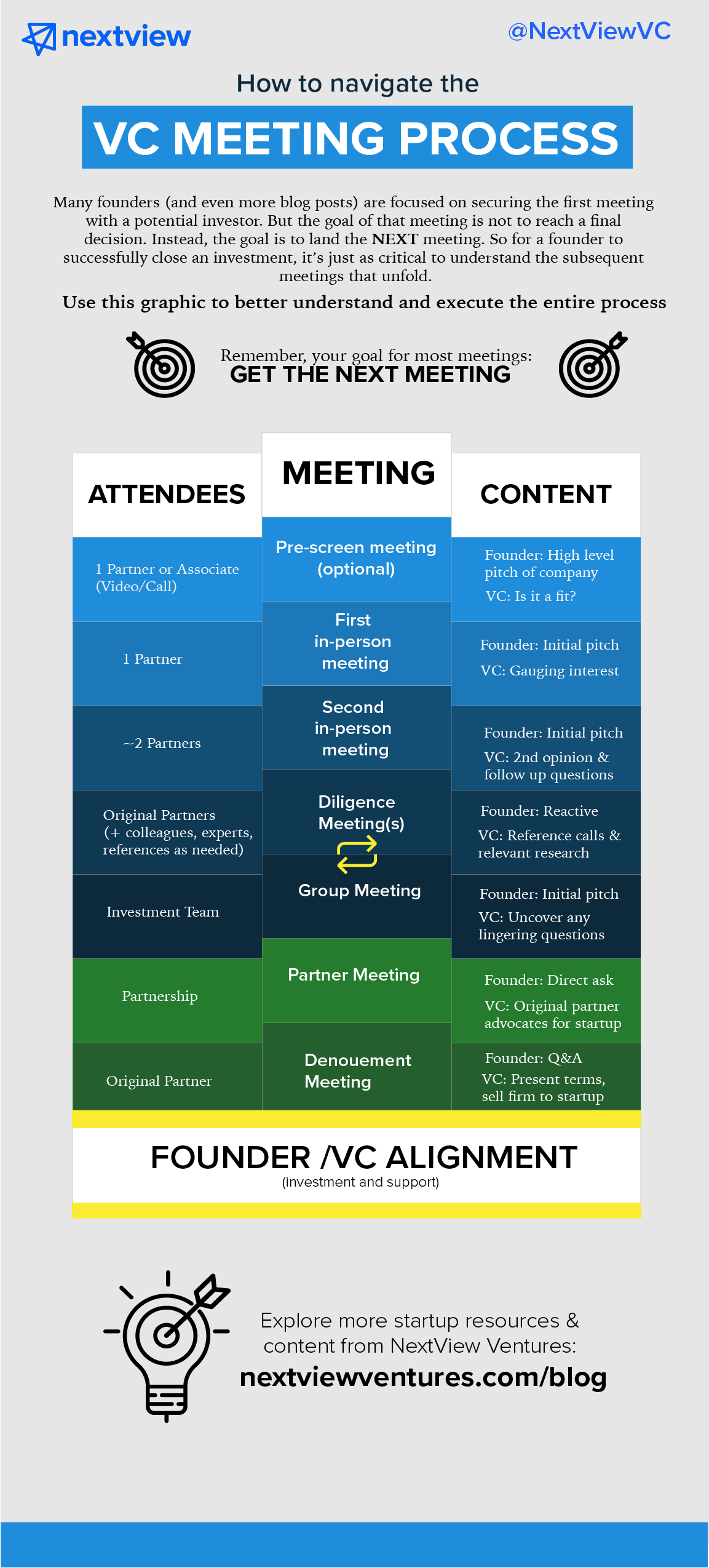

As a result, understanding the general flow is absolutely critical for founders so they understand where they are in the process and how to treat each step. Below is a general overview of what the typical process might look like, as well as a graphical representation you can use as a cheat sheet for what to expect:

Pre-Screen Meeting (Optional). Some VCs are so protective of their in-person calendar or prefer the format of a less-committal (video) call prior to getting together in person. This conversation is typically quite short (less than twenty minutes) and its intent is just to quickly assess if the opportunity itself is even on the fairway of being relevant to the firm and/or if the team is a level of credibility to be considered. Sometimes instead of a Partner-led pre-screen, a junior investment professional conducts this conversation instead, whether it’s on the phone or in person. If it seems like there is a potential for a good fit, the VC firm will invite the founder into the…

First In-Person VC Meeting. With usually just one of the VC’s partners in the room, the intent of this meeting is to genuinely explore if the opportunity is interesting enough for the firm to take seriously as an investment opportunity. Whether it was the referral or a pre-marketing deck which caught the attention of a partner to make the meeting happen, all VC dialogs begin at the same starting line. Even if the intent and the founder’s style is to be more conversational than formal in a structure pitch, starting with the deck as a way to frame a conversation is the best way to start the discussion. And regardless of how an entrepreneur leads the session, the intent is not to ask for a commitment (or even direct feedback) immediately. The partner here is trying it on for size in her head, thinking through her own and what will be her partners’ objections, not making a real decision. Instead, the key to a successful first meeting is to be subsequently invited back for a…

Second Meeting. This second visit to a venture firm’s office usually this involves an additional second partner who acts as a second set of eyes for the partnership. From a VC’s perspective, this meeting’s goal is to both (A) confirm the original intuition and ensure it’s not off base and (B) ask follow-up questions about specific topics or issues which surfaced upon reflection in the time period between the first meeting and now. For the entrepreneur, she should just plan to use the same conversation/pitch format as the first meeting. It’s seems quite repetitive, but this second meeting will likely be 80% of the exact same content in this second meeting. But, if all goes well, the original (lead) partner will begin a series of…

Diligence Meetings, Conversations, and Deskwork. Once two partners have decided the investment is worth pursuing, the process becomes a bit more ambiguous and less standardized. What follows next is “diligence” – a series of homework assignments, meetings, and phone calls led by the original VC partner to validate the opportunity and explore any concerns within his or her partnership. Sometimes it’s tough for founders to really know if the process is progressing forward or not. The most visible signal is that it should feel as though things are accelerating, rather than feeling a steady stream of interactions (or worse, a deceleration). Either the VC is getting increasingly excited or not and is prioritizing this investment over other things on her plate. While founders should feel free to ask questions about a firm during the earlier meetings, this is also the best time to get to know the VC partner, his/her style and personality, and how the startup would fit into the investment strategy of the firm as whole. If the diligence period ends up positive for the company/team/entrepreneur, a common next step is a…

Broader Audience Meeting. (This meeting is often optional.) Depending on how large a VC firm is, in particular in multi-sector/multi-stage/multi-geography partnerships, occasionally it’s necessary from an internal process point to loop in a larger set of the investment staff to the startup’s story even prior to the final partner meeting (more on that below). In other words, it’s a time to “meet the NYC investment team,” or “meet the whole consumer internet focused team.” The purpose of this broader audience meeting is for the original lead partner to socialize the investment now that it’s building steam in order to uncover any lingering questions from others so they don’t surface unexpectedly later on. And even though it’s a complete repeat for a founder, the same initial presentation, taken from the top, should be used again. As you work towards a final decision, next you can expect the…

Partner Meeting. Most often, this moment is where “the decision” is made. You could argue that every previous meeting is equally as important as this one, as they’re interconnected, but the partner meeting is the most important single interaction. In smaller firms where communication is more free-flowing (like here at NextView), this pitch can be more confirmatory than evaluatory. But in contrast, in larger partnerships with more distributed actors yet central decision-making, where some people are hearing your story first-hand for the first time, the outcome of this meeting can be quite volatile. Typically by this point, the lead partner has transformed from a skeptic into an advocate for the investment, building a sincere rapport with the founder along the way, and may (hopefully) prepare him with tips and guidance on navigating this meeting effectively. Only now should an entrepreneur convey the direct “ask” and push for an immediate, definitive decision. Almost always, as soon as the entrepreneur leaves the room, the firm’s investment decision is discussed immediately. If there is mutual interest in proceeding, and, after any necessary back and forth around the specific ask concludes, a positive outcome for both sides is to hold a…

Denouement Meeting. Once any firm has made a decision internally to invest, they don’t want to lose out on the opportunity. Very quickly the tables turn and often a VC requests a follow-up (sometimes in-person) meeting to present a term sheet, talk through terms, sell their firm, and also sometimes conduct “confirmatory diligence” (dot the I’s and cross the T’s on diligence questions, though this won’t affect the outcome).

Especially during the early days of a startup, we at NextView believe the fundraising process is about finding true believers, not convincing the skeptics. So by the end of it, there should be a shared perspective between founders and investors about the vision for the company and how the relationship will work. Although the visible consummation of the process is a term sheet, the real outcome – alignment with a supportive partner – is even more important.

Meeting Process Visualized: