Rob Go

It’s become increasingly common for startups to raise several seed rounds, and this has led to a bifurcation in the seed stage between what are known as “pre-seed” (or “genesis”) and institutional seed rounds.

There are no strict distinctions between these rounds, but below I’ll try to throw out a few parameters to help set the boundaries. For now, it’s fine to think about pre-seed rounds as relatively small ($750K or less), early (pre-product), and typically followed by a larger round within 12 months ($1M – $3M). This is actually an imperfect definition, but let me first talk about why these are happening in the first place. After all, aren’t seed investors (like us) by definition supposed to be the first and earliest-stage investors?

What Caused the Rise in Pre-Seed Rounds?

There are a number of factors that have contributed to the rise of pre-seed rounds, but the strongest have been the frothy late-stage financing market, coupled with both the scaling-up of some of the early winners in the institutional seed ecosystem and the scaling-down of some larger funds that retrenched after the financial crisis.

At NextView, we prefer to think in terms of a startup’s actual business progression rather than round names.

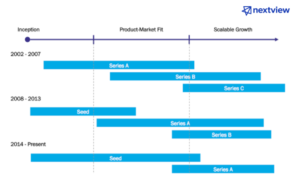

With that in mind, let’s look at an illustration of these trends below, which demonstrates what’s been happening to early-stage financing rounds over the last 15 years or so.

In the years immediately prior to the popularity of institutional seed investing (I’m using a time frame of 2002 – 2007), the early-stage financing landscape looked similar to the first segment of the chart. Series A investors invested quite early, often before product/market fit. The goal of the Series A was to get a company to that product/market fit, while the goal of the Series B was to help a company build a repeatable growth machine. The Series C and later rounds were focused on scaling and driving companies towards an exit.

Over this time period, a few things happened to change the rules of the game. These are well known, so I won’t go into much detail but: The combination of the capital efficiency of early stage software companies, the increase in VC fund sizes, and the rise of institutional seed funds created a fairly different early-stage landscape in the following five years. (I used 2007 as the marker to delineate this, but the trend probably started a bit sooner.)

For reference, First Round Capital and Softech were founded in 2004 (although they were less institutional early on), Floodgate in 2006, Harrison Metal in 2008, etc.

So, between 2008 and 2013, the early-stage landscape looked more like the middle segment of the chart. Seed investors invested close to inception with the goal to taking companies to product/market fit, while Series A investors started looking for opportunities with more demonstrable PMF and early traction and invested larger amounts at somewhat higher prices in later-stage companies. The entire funding progression of startups pushed out to the right.

Over the last several years, however, this trend has continued even further. Series A investors today often focus on companies with substantial traction, and of late have been willing to pay higher prices to get into these companies. The reasons for the shift are:

- Late-stage financing froth. It’s no surprise that in the last few years, the late-stage financing market has been going bananas over companies with great top-line growth, leading to the overfunding and overvaluation of many companies. This means that it has rewarded Series A and B investors for chasing momentum and made it less important for these investors to focus on valuation or sound, early unit economics. As a result, these investors have been able to stray from their bread-and-butter, early-stage investing, because they would be rewarded in later rounds with markups from other late-stage investors. This is now coming to an end, but irrational late-stage capital still exists in the market today.

- The proliferation of seed-stage investors. The rise of more institutional seed funds created an increase in the number of companies raising Series As during this same time period. As a result, Series A investors could really hang back and just wait for the companies that broke out from the pack in terms of traction or for those that were founded by blockbuster, repeat entrepreneurs.

The result of these trends is that the scope of a seed round has stretched significantly.

Many Series A investors are looking for the magic combination of very strong PMF + meaningful traction. Anything before this is a seed-stage company to them, which means that any two seed-stage companies can look very different. Just yesterday, for instance, we saw a company raising a seed round that has no product and two founders … and we also saw a company raising a seed with hundreds of thousands of dollars of monthly revenue.

In addition to this scope-creep in the definition of seed rounds, a number of the early winners in the institutional seed business have gone on to raise much larger funds or have progressed upwards into being something other than a seed fund. This has allowed these firms to invest larger amounts at the later end of the seed spectrum, and some have even started to lead or syndicate Series A rounds with others. It turns out that it’s often easier to invest in companies with some level of PMF versus working closely with founders to try to get a company to that threshold and absorb the additional risk of doing this. (FWIW, that is not how we operate.)

Thus, with all of this context as the backdrop, it became increasingly difficult to raise your first $200-500K of funding to start assembling a team and building an early product. A company at this stage increasingly became “too early” for more “traditional” seed investors. The expansion of the definition of seed and the increased scale of institutional seed investors essentially created a bifurcation between pre-seed and institutional seed.

And all of that is a lot to absorb and understand, let alone react to as an entrepreneur who’s full-time job is not to fundraise. So here’s what I’d propose:

A Better Definition of a Pre-Seed Round

Let me close this post with a more nuanced definition of a pre-seed round than earlier. In my view:

A pre-seed is an early round of financing that is designed to help a company achieve certain intermediate milestones PRIOR to the magic combination of strong PMF + meaningful traction.

These milestones differ case-by-case, but a few might be:

- Recruiting a critical team member (e.g., technical co-founder)

- Overcoming some sort of regulatory hurdle or some other near-term existential risk to the business

- Creating a hack of a product that demonstrates the likelihood of PMF

- Moving to a new geography

- Building the credibility of an unproven team

Out of this comes round size and stage of the company.

The round size of pre-seeds tend to be smaller because of three reasons. First, the teams are smaller, and so the intended burn is lower. Second, the time frame required to achieve these milestones are often shorter than the standard 18-24 months. Third, founders at this stage have an incentive to minimize dilution at the point when their equity is the least valuable. This is why pre-seeds tend to be between $50K and $500K.

Also, the stage of the company tends to be very early. This is because, if a company were further along, they would most likely try to achieve the magic milestone of strong PMF + meaningful traction. In my experience, the valuation increase tends to be more significant at that milestone than any other, so founders that have this within their sights are incentivized to try to clear that hurdle.

But this is why stage alone does not define a pre-seed.

Many seed investors (as well as Series A investors) will back a founder at a very, very raw stage. These rounds, however, tend not to be considered pre-seeds because they are fairly large — certainly large enough to have a shot at getting to PMF + traction. These tend to be cases where founders are proven. They are either repeat successful founders or first-time founders who are still well-known and well-respected individuals by the lead investor. These rounds are thus pre-seed in stage, but the companies are capitalized to get through all the milestones required to try to get to a Series A on the other end.

This begs the following, important question:

Does this all mean that pre-seed rounds are by definition only targeting less credible founders and have inherent adverse selection?

I’ll answer this question in my next post, as well as share how we approach pre-seed investing at NextView.